Overview:

Here

you will select cash account or bank account some times company has different

two banks accounts so in this option you will change account.

Here

you will select cash account or bank account some times company has different

two banks accounts so in this option you will change account.

Receipts is generally prepared when cash is received

against sales this tab allow you different option which discuss below step wise

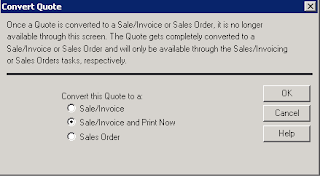

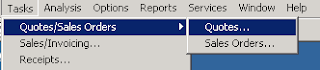

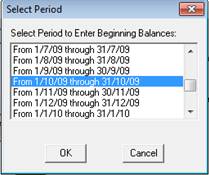

Step

1:

Step

2:

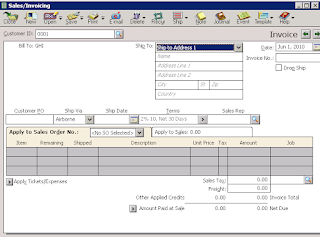

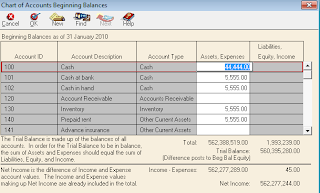

A

receipts window will appear which has different tabs such as cash tab, customer

information tab, Apply to sale revenues and apply to invoice.

Customer

information:

In

this section you will write information related to your customer. Deposit Ticket ID here you will type ID

ticket which you save in your accounts.

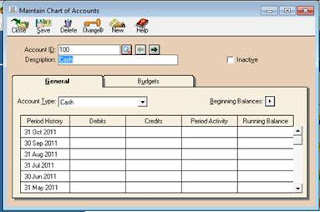

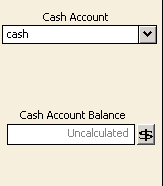

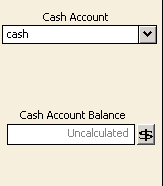

Cash

account:

Here

you will select cash account or bank account some times company has different

two banks accounts so in this option you will change account.

Here

you will select cash account or bank account some times company has different

two banks accounts so in this option you will change account.

Cash

amount balance: Here you will check your cash in hand

balance.

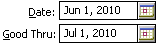

Date:

Here you will first change the date and type the date on which you receive

payment from customer,

Receipt

number: Here you will select receipts number.

Receipts

Amount: The amount which you received against sale is

written in this box.

Payment

method: You can change method for example may select credit card

option.

Apply

to revenue:

Here you will write the amount of sale which you

sale without issue of sale invoice for example extra unit for sale which not

included in invoice of particular customer.

Step

4:

First you will select you customer from customer ID

then apply to sale invoice will edit able now you can record sales against sale

invoice.

Step

5:

Here

you will types information in related box and click on pay option.