Overview:

“Basic purpose to maintain chart of accounts is mention the accounts and there types, ID, descriptions. We can also delete and inactive the account and set the beginning balance for the current year or previous year.”

We will perform this activity stepwise

Step 1:

For this we first click on “Maintain” option we will show menu open which contain options of Customers,Vendors , Charts of Accounts, Inventory items… ,Costs items….,Fixed Assets,

Company information..., Sales Tax e.t.c

Step 2:

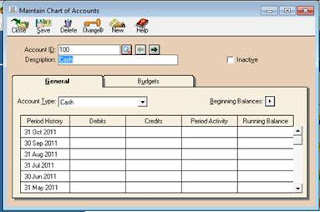

After click “Charts of Accounts” we will get the window which mention right side. Main reason of charts of accounts is add new accounts, define account type, account description, delete accounts, change account ID and describe company accounting record.

After click “Charts of Accounts” we will get the window which mention right side. Main reason of charts of accounts is add new accounts, define account type, account description, delete accounts, change account ID and describe company accounting record.

There are some box titles which we should discuss

Account ID:

We mention a digits for accounts which specify there identifications in software is called Account ID for example we mention 100 for our cash account and 101 for cash at bank Accounts. In below table all the digits are identification of Accounts.

Note: For distinctive purpose we use 100 figure for assets,200 for liabilities,300 for capital, 400 for sale , 500 for cost of sale, 600 for all expenses

ID

|

Description

|

Account Type

|

100

|

Cash

|

Cash

|

101

|

Cash at bank

|

Cash

|

110

|

Account receivable

|

Account receivable

|

111

|

inventory

|

inventory

|

120

|

Prepaid rent

|

Other current asset

|

121

|

Advance insurance

|

Other current asset

|

150

|

Land and building

|

Fixed asset

|

151

|

Machinery

|

Fixed asset

|

152

|

Vehicle

|

Fixed asset

|

153

|

Acc. Dep Building

|

Accumulated depreciation

|

154

|

Acc. Dep Machinery

|

Accumulated depreciation

|

155

|

Acc. Dep Vehicle

|

Accumulated depreciation

|

200

|

Account payable

|

Account payable

|

210

|

Salaries payable

|

Other current liability

|

211

|

Interest payable

|

Other current liability

|

212

|

Short term loans

|

Other current liability

|

300

|

Capital

|

Equity doesn’t close

|

301

|

Retain earning

|

Equity retain earning

|

302

|

Dividend

|

Equity gets close

|

400

|

Sale

|

income

|

500

|

Cost of sale

|

Cost of sale

|

600

|

Rent expense

|

expense

|

601

|

Insurance expense

|

expense

|

602

|

Depreciation

|

expense

|

603

|

Salaries expense

|

expense

|

Descriptions:

In descriptions we enter the account name such as cash , Account Receivable e.t.c.

Account Type:

Every account has its own nature for example cash is asset in nature salary is expense , notes payable is liability in nature .In software we have need to write account type

Step 3:

After writing the account ID , description and account type we will press (Alt + S) key to save the procedure or you can press to save.

NOTE: We must create owner’s equity account otherwise it create problem at the end. If we enter the figures then we cannot create this account id

Beginning Balance of Chart of Accounts:

This is use to add beginning balance for current year and adjust the beginning balance of account for prior year.

Step 4:

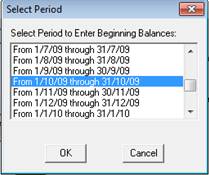

We will click on beginning balance icon then following window will appear which mention right side. Here you will select month of which data is enter for example if trail balance is given on 1st June then May month will be selected.

We will click on beginning balance icon then following window will appear which mention right side. Here you will select month of which data is enter for example if trail balance is given on 1st June then May month will be selected.

Step 5:

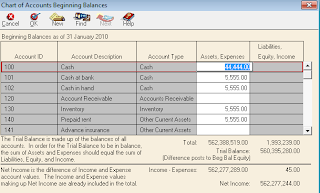

A window will appear in which you will enter the amount of all accounts .At the end its balance will be zero.

A window will appear in which you will enter the amount of all accounts .At the end its balance will be zero.

After changing the ID previous will be block or terminated.

By click on this icon we can delete any selected account.

By click on this we can inactive any account

No comments:

Post a Comment